“Now as the sun rotates and my game grows bigger…”

Snoop Dogg, “Ain’t No Fun (If the Homies Can’t Have None)“

The global gaming market, excluding hardware, was $62B in 2012 and is expected to reach $83B by 2016.*

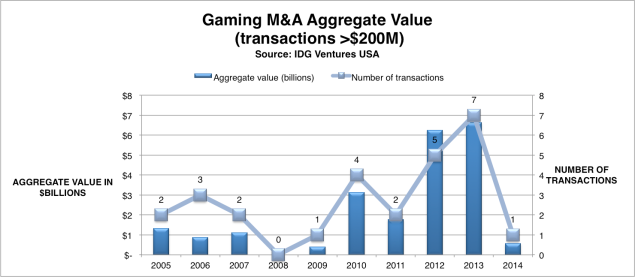

In addition, the number of major exits in gaming has increased significantly over the recent years. Prior to 2008 there were only six M&A exits above $200M; however, since 2008, there have been 20 M&A exits and valuations above $200M with a median valuation of $500M. The following data is based on an IDG Ventures USA‘s study:

The global gaming ecosystem is vast and growing, with opportunities for value generation across development, publishing, developer tools, infrastructure, and platforms. I’m betting on the gaming industry and clearly, for good reason.

If gaming is such a large market with this many exits, why have so few VCs focused on gaming? My answer: the “Zynga Effect.” Investors and the market had high expectations for Zynga, which failed to meet those expectations. A common misperception is that gaming is only a “hit-driven business,” but many successful game companies have been more than one-hit wonders through developing platforms or categories using innovative technology and in depth knowledge of the rapidly emerging gaming markets.

It is my experience that being a contrarian can yield the best returns in the cyclical venture capital world. Since Zynga’s stock tanked in April of 2012 I have added the following eight gaming companies to my portfolio:

IDG Ventures USA and I are incredibly proud to be working with such amazing entrepreneurs and plan to make several more gaming investments in 2014.

* Source: Digi-Capital

Good to know.

LikeLike

Glad to see there is still faith in the value of gaming start ups.

LikeLike

Nice analysis, Phil! Makes me want to get out of this enterprise software racket and into something like this.

LikeLike